The following examples are from our algo trading the S&P500 E-mini Futures, using 5 contracts per trade, on a 512Tick chart.

On 7/14/22 at 10:58 est a potential AB=CD pattern was detected which fulfilled all the required conditions set by the algo. The algo entered in a long trade at 10:58:38, trading 5 contracts of the E-mini S&P500 Futures. E-Mini is highly leveraged, and each point in price represents a $50 move. The algo purchased the contracts at 3.736.75, and predicted the asset would move to the zone indicated on the chart labeled as “PRZ” (Potential Reversal Zone). Subsequently profit was taken as follows : 1 contract at 3,743.25, 1 contract at 3.745.50, and 3 contracts at 3,744.00. the timespan the algo completed the trade from purchasing to closing the trade was less then 2 minutes. in that time span the total amount of points gained was 1 x 6.5 + 1 x 8.75 + 3 x 7.25 = 37. total profit on the trade : 37 x $50 = $1,850.00

Of course not all trades are winners, however our algos keep tight stop losses, thereby effectively maintaining a healthy Risk/Reward ratio. In this example we see a profitable trade on 7/29/22 between 15:43 and 15:50. Again the predicted target, depicted as the PRZ zone was achieved, which triggered the algo to take profits. The trade netted a 18 point win or $900.00 which was followed moments later at 15:51 by a losing trade of 5 x -1.75 = -8.75 points, resulting in a -$437.50 loss.

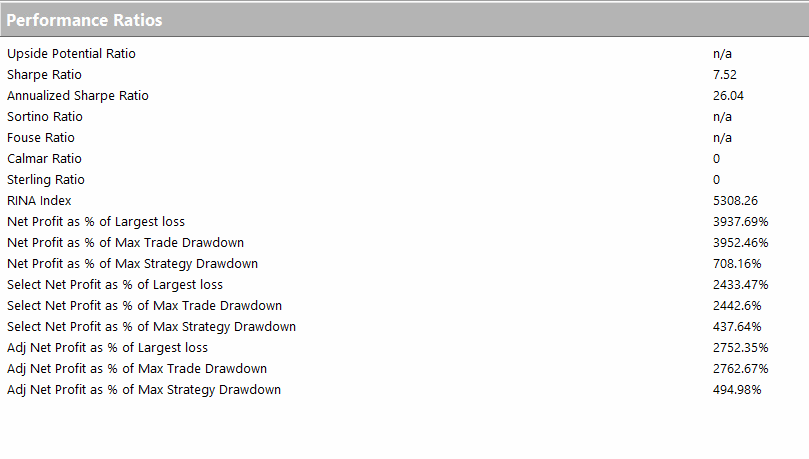

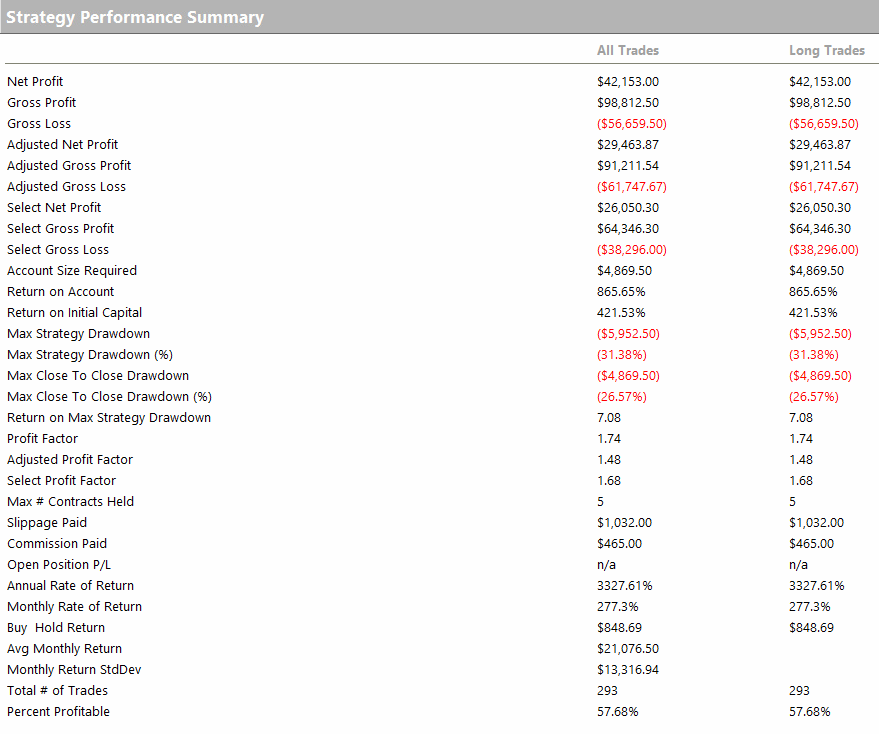

The Emini’s trade contracts that expire every quarter. The examples shown here are for the ticker ESU2, which is the E-Mini SP500 future contracts for the ’22 3rd quarter between June and September. Below is the equity curve for this, between 6/13, the date it started trading and time of this writing 7/30/22, together with the strategy performance summary, and performance ratios.